Download all planning task two worksheets using the link above.

In this task, you will begin exploring your readiness for transition by taking stock of past experiences and by preparing an inventory of current resources. The farm histo-ry and current situation summaries that you develop here will help you communicate to family members, other business partners and lenders that you have the experience and resources needed to make a successful transition. After completing this planning task you will be ready to write the following sections of your business plan:

- Business Overview

- Farm Business History

- Land and Other Resources

- Current Operations

- Current Marketing

- Current Human Resources

- Current Financial Position

- Historical Financial Performance

Using the worksheets in this planning task, you will begin by briefly documenting your farm and business history—recording business strategies that have been successful, describing how you have managed risk during difficult times or how you have responded when plans did not unfold as expected. You also will document resources (including people skills) that will be available to the business as you transition, and prepare financial docu-ments that will help when assessing the feasibility of transition strategies. Let’s begin!

Farm Business History

You have several options for documenting your farm’s history: photos, a timeline and text. However you approach this, do so with the intention of communicating to someone who is unfamiliar with your farm business. Begin documenting your farm business history by reflecting on past successes (and, yes, perhaps some challenges or failures too). What would you want someone to know about the farm and your management practices, past productivity and marketing of crops, livestock, or products and services? Has the farm changed in size or in management since you acquired the land that you now farm? How have you managed risk? In other words, what has led you to this point? Be sure to describe success-es and lessons learned over the years.

Farm History

In 1935, Nathan’s grandparents moved to this farm with six Guernsey cows. They raised 14 children and farmed through many ups and downs. Nathan and his father, Fred, farmed together until Nathan and Angie purchased the farm in 2002. “We milked 80 cows in a stanchion barn, switching one time. There were 40 stanchions and 40 free-stalls. … In 2011 we began transitioning our farm to organics. We have never used [the growth hormone] BST and rarely have used antibiotics, so we felt that organic was a good choice for us. We are on track to be shipping organic milk to Organic Valley in the fall of 2013.”

If you are new to farming, try thinking of this as a meet and greet, where you have the opportunity to introduce yourself to someone. Describe your skills, the experience that you bring to the table and the history of the new land you will manage. Do not worry about polishing your story or getting every detail just right. Instead, take 10-15 minutes to chronicle your past using Worksheet 2T.1: Farm History, reproduced from the Guide. See the story panels for examples of farm histories.

Current Situation

Next, take time to document your current operational, marketing, human resource and financial situation. This can be a time-consuming task, but it is critical when mapping out strategies to get you from here (pre-transition) to there (certification). Your resource inventory should include marketing resources (infrastructure, contracts, competitive-ness), physical resources (buildings, equipment, fields, livestock), human resources (labor, knowledge, skills) and financial resources (income, cash flow, working capital, financing). We will get you started with worksheets for each area.

Operations

It is important to document current physical resources and management practices. Doing so will make it easier to identify available operational assets and resources needed to make a successful transition. Physical resources include land, buildings and other structures, as well as machinery, equipment, water supplies, breeding livestock and poultry. The quantity and quality of tangible assets that you control can significantly affect future opportunities.

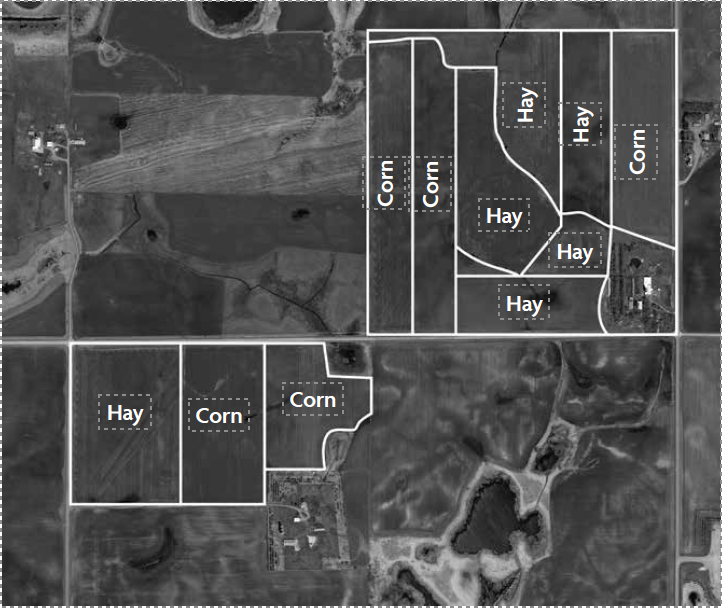

Begin documenting your current resources by drawing a map or obtaining an aerial pho-tograph of your fields and buildings. Record your map using Worksheet 2T.2: Current Farm or Facilities Map. (Google Earth, available on the Internet at no cost, has built-in tools that allow you to map fields from aerial photographs. See the Resources section for more information on where to go for more traditional aerial maps.) For land, depict or write in crop rotations or grazing patterns for the previous one to three years. Also indicate the locations of perennial crops, conservation easements, buffer strips, water supplies, buildings and non-tillable acreage. This information will provide the basis for planning crop planting, rotation and harvest schedules as well as livestock housing, feeding and grazing schedules during transition and beyond. Your mapping inventory should also include notes about land type, soil class and soil quality for each field. Certifiers and other organic production specialists recommend having your soil tested to determine nutrient availability before establishing future crop and livestock rotations. Figure 2T.1: Current Farm or Facilities Map shows a farm map from a transitioning crop farmer who rents fields at various locations.

Farm History

I am new to farming but have experience as an entrepreneur and have operated a successful computer business for the past several years. In 2012, I purchased a small farmstead with 1.75 acres to begin cultivating my agricultural production skills. During 2013-2014 I acquired hands-on experience growing radishes and mustard greens while completing a beginning farmer program with the National Organic Farming Association of New Jersey. Most recently, I participated in four courses as part of the Organic Processing Institute’s School for Organic Processing Entrepreneurs to gain a better understanding of organic processing and handling requirements.

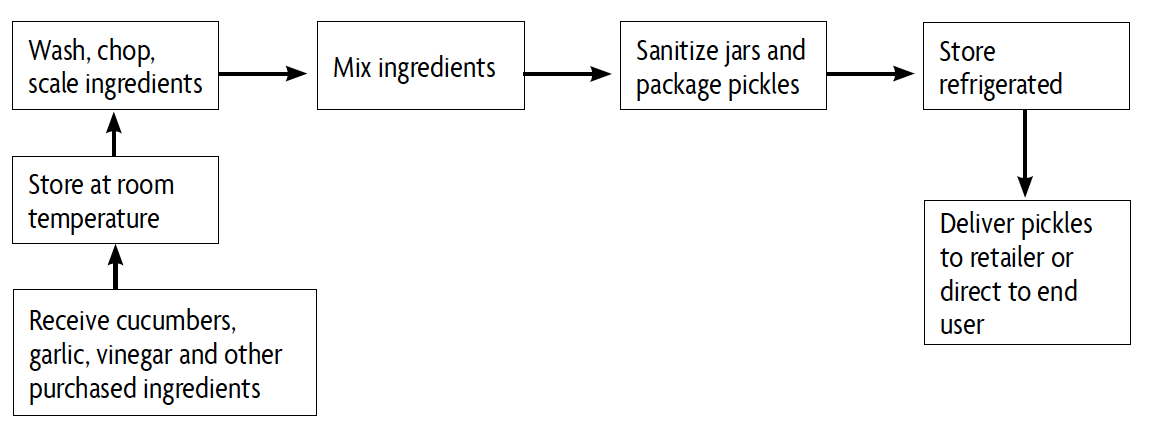

If you process (e.g., wash, cook, preserve, dry, cure, ferment), create a facility map or diagram showing the size of the building(s) and what type of equipment you own or rent (e.g., sinks, boilers, freezers, ovens). We also recommend developing a flow chart depict-ing steps, stations and activities performed when processing. See Figure 2T.2: Processing Flow Chart, Pickles for an example.

After creating a farm or processing map, use Worksheet 2T.3: Current Operations to summarize the products and services that you produce and to briefly describe how you produce them. When doing so, be sure to record:

- types of products/services produced

- volume produced

- custom hire work performed

- inventory management and quality control

- rental/lease agreements

- seasonal considerations

Much of the information that you record on this worksheet can be included in your busi-ness plan and in your OSP or OSPH. It also will provide the information needed to do effective strategic planning in Planning Task Four: Strategic Planning. Be sure to check out the Dig Deeper section at the end of this planning task for suggestions on where to go in the Guide for worksheets that will assist you with more detailed operations planning.

Next, take a few minutes and use the worksheets provided (Worksheets 2T.4-2T.6) to briefly answer the question, How close am I to farming or processing organically? If you are unfamiliar with the differences between conventional and organic management, check out Table 2T.1: Comparison of Organic and Conventional Agriculture. If you are new to farming or are unable to answer some of the questions, leave the worksheets blank. These worksheets are provided simply as a way to help you narrow down what will be most important or needed when developing strategies in Planning Task Four: Strategic Planning.

| Organic Agriculture | Conventional Agriculture | |

| Fertility | Non-synthetic amendments like manure, compost and green manures; legumes in rotation | Primarily synthetic fertilizers |

| Weed Control | Multiple strategies are employed, including: diverse rotations, mechanical weed control, cultural methods | Primarily synthetic herbicides, GMO crops |

| Insect Control | Diverse rotations, some non-synthetic insecticides, biological control | Primarily synthetic insecticides, GMO crops |

| Crops | Non-GMO only | Either GMO or traditionally bred |

| Rotations | Diverse rotations that include other crops in addition to corn and soybeans | Often includes just corn and soybeans; continuous cropping is possible |

| Profits | Comparable to conventional | Comparable to organic |

| Inputs | Fewer inputs | More inputs |

| Buffers | Buffers are necessary to protect organic crops from GMO contamination, pesticides | Buffers are not required |

| Time in Field | Buffers are necessary to protect organic crops | Depending on the crop, less time may be spent in the field |

| Yield | Corn and soybean yields have the potential to be lower but small grains and forages can have similar yields | Can be higher depending on crop fertilization, chemical weed control |

Marketing

Use Worksheet 2T.7: Current Marketing to document commodities, products and services that you currently market, as well as the volume of product sold last year. Be sure to record average or contracted market prices, or both. If you use marketing contracts to sell forward, you should describe the contract terms in this section. See the story panels for examples of marketing practices. Next, describe current market trends, including anticipated changes in conventional markets and opportunities to market organically. Opportunities may be formal (e.g., the opportunity to contract with a processor or retailer) or informal (e.g., the opportunity to sell to a neighbor). Use Worksheet 2T.8: Current Enterprise Sales to calculate your revenue from crop, livestock and processed product enterprises. This information will provide the basis for organic marketing strategies that you develop in Planning Task Four: Strategic Planning.

current Marketing Practices

We currently market all of our milk to the local creamery. Conventional milk prices have varied from $13 per hundredweight to $20 per hundredweight over the past five years.

We obtain forward contracts at profitable prices to help lock in our current-year cash flow and to assure the bank of the value of the products we produce. We are in regular contact with eight wholesale commodity brokers to research and finalize our contracts.

Human Resources

You have looked at operations and marketing. Now it is time to document your current human resources situation, to describe the people that keep your farm going and help make your business successful. Later, in Planning Task Four: Strategic Planning, you will have the opportunity to identify labor needs based on your transition goals and explore strategies for filling any gaps. For now, however, list the people involved in your business—family, partners, hired labor, consultants and interns—using Worksheet 2T.9: Current Human Resources. Then describe each person’s role on the farm, identifying managers, full-time workers and part-time workers as well as the activities that they perform. This worksheet will provide a snapshot of the types of jobs that exist on your farm and the workload of each person currently employed.

As you inventory physical and human resources, keep in mind that you may be the most important resource to consider. We have all heard it said that the learning curve can

be steep when transitioning from conventional to organic management. Organic apple growers, for example, must learn to use complex—often experimental—pest management strategies to control over two dozen arthropod pests that affect tree health, fruit quality and fruit yield.2 Every farmer who has made the transition, no matter what they produce, will tell you to expect new challenges and to be prepared to learn new skills. So, the big question is, are you ready?

Use the management assessment Worksheet 2T.10: Are You Ready to Manage Organically? to find out just how ready you are to face some of the challenges and risks associated with organic farming. If you find yourself answering yes to many questions on the list, be sure to document these qualities in your business plan. These can help demonstrate to a lender, certifier, buyer or future business partner that you are ready to farm organically.

Finally, recordkeeping will be a critical human resource when transitioning and once certified. Recordkeeping tools include calendars, notebooks, preprinted forms and computer software. Many farmers have developed their own spreadsheets to track input purchases and applications, labor and machinery hours, productivity (yields, animal output), and sales. Use Worksheet 2T.11: How Good Are Your Records? to document current recordkeeping practices.

If you already maintain detailed production, marketing and financial records, be sure to mention this in your business plan. If, on the other hand, you are not used to keeping records or your system is akin to keeping receipts in a shoebox, be aware of what lies ahead! Good records are essential for obtaining certification and for documenting marketing contract compliance. Also, they are useful when evaluating business successes and failures; most farmers find them to be indispensable management tools. You will have a chance in Planning Task Four: Strategic Planning to explore recordkeeping options and choose a system that works best for your business while satisfying OSP and OSPH requirements.

Finances

Knowing your financial status is critical when planning for transition. This is especially true if you expect to lease land, hire labor, purchase certified organic feed or acquire new equipment. Why? Knowing your financial situation before making a major change in operations allows you to explore options on paper before investing. This exercise will also prepare you for meetings with lenders and potential investors. As National Center for Appropriate Technology Agricultural Specialist Hannah Lewis puts it, “If you are comfortable answering questions about your financial situation for yourself, you will be able to answer the same questions for a lender.”3 Most importantly, the work you do here to document your financial situation will provide a baseline for strategic planning later on; it will help you determine if certification goals are financially feasible.

Begin by estimating family living expenses and income needs. If you do not have a personal budget, now is a time to prepare one. Use Worksheet 2T.12: Current Family Living Expenses or the “Living Expenses” spreadsheet to estimate current spending. The information you provide here will be very useful when budgeting for expenses during the transition period.

Next, record current farm expenses using Worksheet 2T.13: Current Farm Expenses. See Text Box 2T.1: Sample List of Farm Operating Expenses for a list of typical farm expenses that you may want to include when calculating total cash operating expenses for your income statement. If you are new to farming, you can skip this worksheet or use it to prepare your first expense budget.

Finally, we suggest preparing a current income statement, cash flow and balance sheet for your farm business using Worksheet 2T.14: Current Income Statement, Work-sheet 2T.15: Current Cash Flow, and Worksheet 2T.17: Current Balance Sheet. Text Box 2T.2: Calculating Depreciation describes how to calculate depreciation, which is also needed for your income statement. You can use Worksheet 2T.16: Calculating Depreciation and Inventory Changes for this purpose. Later, in Planning Task Four: Strategic Planning, you will compare your current financials to projected income, expenses, cash flow and net worth to determine how the transition to organic management may impact finances.

Sample List of Farm Operating Expenses

Crops/Livestock

Crops

• Seed

• Fertilizers (e.g., manure)

• Irrigation energy

• Cleaning and drying

• Storage

• Other

Livestock

• Feeder livestock expenses

• Feed and forages

• Pasture expenses

• Breeding fees

• Breeding livestock

• Veterinary

• Other

Equipment/machinery

• Lease

• Repairs and maintenance

• Fuel and oil

Buildings

• Rent

• Repairs and maintenance

• Utilities

Land

• Rent

Miscellaneous

• Labor

• Office supplies

• Other

Processing

Materials

• Ingredients

• Processing aids

• Containers

• Labels

• Other

Equipment/machinery

• Lease

• Repairs and maintenance

• Other

Buildings

• Rent

• Repairs and maintenance

• Utilities

• Rent and leases

• Other

Miscellaneous

• Storage

• Labor

• Office supplies

Calculating Depreciation

Depreciation is defined by the Internal Revenue Service as “an annual allowance for the wear and tear, deterioration or obsolescence of the property.” Most types of tangible property are depreciable, such as buildings, machinery, vehicles and equipment, but land is not. When estimating depreciation, the Center for Farm Financial Management suggests using 10 percent per year of the purchase price of machinery and equipment, 15 percent per year of the purchase price of titled vehicles, and 5 percent per year of the purchase price of buildings and other improvements.

It is a good idea to look at your farm business’ overall competitive situation—to document the current internal strengths of the business as well as opportunities that exist in the marketplace or elsewhere outside of your business. Explore your current competitive situation using Worksheet 2T.18: Current Whole-Farm SWOT. You also may use this worksheet to identify current internal weaknesses and external threats to the farm business. SWOT statements (“Strengths, Weaknesses, Opportunities and Threats”) are classic business planning assessments. Your SWOT statement may also address less tangible, visionary ideas. Newly certified organic dairy farmer Kent Hoehne from Frazee, Minn., for example, included the following opportunity in his SWOT:

“I’m excited about [organic] crop farming because as an organic farmer, you are ‘farm-ing.’ You are learning about rotations and the viability of the soil. If I am excited, maybe I can pull some other kid along with me. I think organic farming is an opportunity to change the future of agriculture in my community.”

It is a good idea to address the four business characteristics (operations, marketing, human resources and finances) when describing your SWOT, if applicable. While you may not include a discussion of your farm’s weaknesses and threats in the final business plan, it will be useful for all planning team members to be aware of these conditions as you move forward to develop transition strategies. Also, the information from your SWOT can be useful when developing contingency statements in Planning Task Five: Implementation and Monitoring.

Dig deeper

For more information, ideas and examples about how to document your history and cur-rent situation refer to pages 27-66 in the Guide. You may also want to complete Worksheets 2.15-2.18 in the Guide. These financial worksheets will provide further operation-al and financial baselines for your farm business. The answers that you provide on these worksheets will be valuable as you build strategies and communicate with others, such as business partners, lenders, buyers and certifiers. Other worksheets from the Guide that we recommend when digging deeper are:

Worksheet 2.3: Tangible Working Assets. When completing this worksheet, be certain to note the current or potential certification status of leased or rented land. This worksheet will give you a good start on the problem-solving required in Planning Task Four: Strategic Planning. For example, after using it to identify needed resources, you will be ready to think critically about how best to fill any resource gaps.

Worksheet 2.4: Institutional Considerations. This worksheet provides space for you to document current access to rental acreage or leased land. Be sure to note the con-ditions and terms of your current agreements, making special note of the length of these agreements and whether your landlord is on board for the transition. It may also be worth asking about rental rates during and after transition. In some cases, landlords are willing to offer a variable rental rate, where prices are reduced during transition to help offset cash flow bottlenecks and then are increased after certification to offset the discounted rate you had been receiving.

Worksheets 2.9-2.10. These worksheets will be important to review if you have a large number of people involved in business operations or if human resource issues are among the main drivers behind your decision to develop a business plan.

Worksheet 2.17: Risk Management. This worksheet asks you to rank your farm business’ exposure to risk in marketing, operational, financial and personal areas. In Planning Task Four: Strategic Planning, you will compare current risks to potential transition-related risks. This will be an important part of feasibility testing when evaluating your final transition strategy.

Put it in writing

Record a brief statement about your farm history in AgPlan in the Farm Business History section or using your own word processing program. If you have compiled a page or more describing your farm business history, consider condensing it for the business plan. This is the place to be brief; one to two paragraphs, or even a few sentences, will do. After writing your farm business history, identify current resources and comment on your readiness to go organic.

If using AgPlan or the outline suggested on page 19, complete the following additional sections:

- Business Overview

- Current Operations

- Land and Other Resources

- Current Marketing

- Current Human Resources

- Current Financial Position

As with the Farm Business History section, we suggest that you be brief when completing these AgPlan sections. Two or three paragraphs will suffice. For example, rather than list-ing under Current Operations all of the organic management practices that you currently employ, simply summarize the information reported on Worksheets 2T.4-2T.6 How Close Am I to Farming Organically?.